Wage calculator with overtime

This free online monthly employee timesheet calculator with 2 unpaid breaks and overtime will add up your or your employees time clock hours for the month and calculate your gross wages. The salary calculator will also give you information on your weekly income and monthly totals.

Let us know your questions.

. Estimate garnishment per pay period. Ad Takes 2-5 minutes. This overtime calculator figures your total overtime paycheck and the OT rate together with the regular pay by taking account of the number of hours worked.

1000154 1500 4 6000. Compare options to stop garnishment as soon as possible. Therefore Virginias overtime minimum wage is 1650 per hour one and a half times the regular Virginia minimum wage of 1100 per hour.

Baca Juga

These figures are pre-tax and based on working 40 hours per week for 52 weeks of the year with no overtime. After the increase to 865 on January 1 2021 the minimum wage will increase to 10hour as of 9302021 and will increase 1 per year until the rate reaches 15hour on 9302026. Check National Minimum Wage and National Living Wage rates before March 2022.

Ad Payroll So Easy You Can Set It Up Run It Yourself. If you earn more then the Virginia minimum wage rate you are. Texas Overtime Minimum Wage.

Hourly weekly biweekly semi-monthly monthly quarterly and annually. Your employee must be at least 23 years old to get the National Living Wage. Overtime wages are a type of increased payment that employees can earn when they work more than a certain number of hours in a workday or workweek.

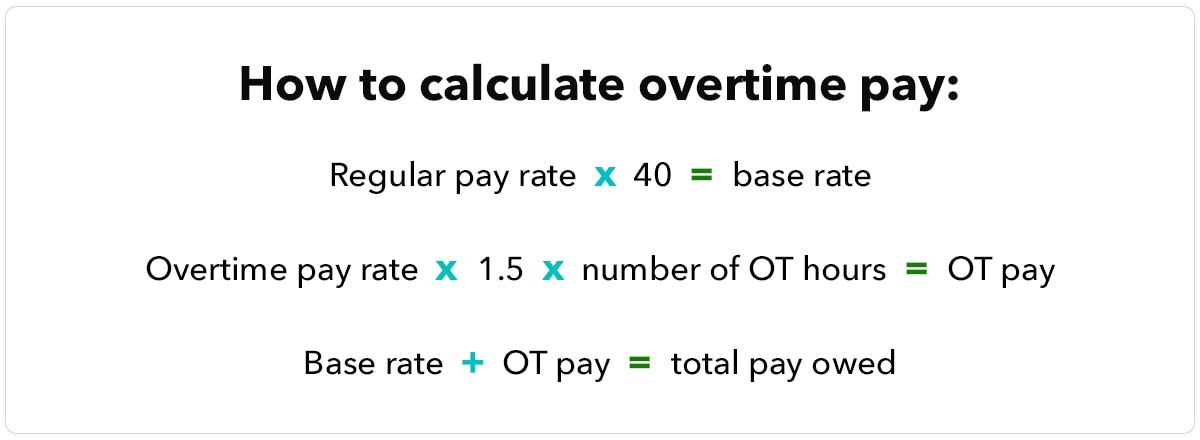

Covered nonexempt employees must be paid overtime pay at no less than one and one-half times the employees regular rate of pay for hours worked in excess of 40 in a workweek. If you earn more then the Texas minimum wage rate you are entitled to at. This calculator can convert a stated wage into the following common periodic terms.

Employee Overtime Calculator is a ready-to-use template in Excel Google Sheets and OpenOffice Calc that helps you easily calculate overtime. The regular rate on which overtime pay is calculated includes remuneration or pay for employment and certain payments made in the form of goods or facilities customarily. This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having regard to how much you are working per day week and pay rate.

His daily wage will be. Overtime pay also called time and a half pay is one and a half times an employees normal hourly wage. Most employees in the United States be paid at least the federal minimum wage for all hours worked and overtime pay at not less than time and one-half the regular rate of pay for all hours worked over.

An employee who is exempt from the overtime pay requirements is not entitled to receive FLSA overtime pay. If you do any overtime enter the number of hours you do each month and the rate you get paid at - for example if. Overtime Security Advisor helps determine which employees are exempt from the FLSA minimum wage and overtime pay requirements under the Part 541 overtime regulations.

Protections for Workers in Construction under the Bipartisan Infrastructure Law. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. Overtime Calculator Advisor computes the amount of overtime pay due in a sample pay period based on information from the user.

1000 8 8000. You can factor in paid vacation time and holidays to figure out the total number of working days in a year. We have included a few extra options to help make sure the figures you see are spot on.

Thereafter minimum wage will be adjusted based on the Consumer Price Index. All Services Backed by Tax Guarantee. Therefore Texas overtime minimum wage is 1088 per hour one and a half times the regular Texas minimum wage of 725 per hour.

Overtime and an additional hourly rate if you work a second job. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Overtime pay also called time and a half pay is one and a half times an employees normal hourly wage.

How to File a Complaint with the Wage and Hour Division. And if you completed the required regular and overtime wage entries in the top section of the calculator you can tap the Calculate Gross Pay button. This calculator uses the 2019 withholding schedules rules and rates IRS Publication 15.

Florida Minimum Wage Rates by Year. This free online semi-monthly timesheet calculator with 2 unpaid breaks and overtime will add up your or your employees time clock hours twice a month and calculate your gross wages. The most common deductions from employee wage slips are pensions and student loans.

Virginias Overtime Minimum Wage. To help with this the calculator can even tell you how much overtime you need to do in order to get the extra cash you want in your wage packet. And if you completed the required regular and overtime wage entries in the top section of the calculator you can tap the Calculate Gross Pay button.

Use this calculator to convert your hourly wage to an equivalent annual income as well as weekly and monthly wage. Therefore we recommend you review a list of common exemptions before using the FLSA Overtime Calculator Advisor. There is in depth information on how to estimate salary earnings per each period below the.

See where that hard-earned money goes - with UK income tax National Insurance student loan and pension deductions. If you think you may be owed back wages collected by WHD you can search our database of workers for whom we have money waiting to be claimed. The FLSA contains a number of exemptions from its minimum wage andor overtime pay requirements.

Customized for Small Biz Calculate Tax Print check W2 W3 940 941. Most nonexempt employees in California have a legal right to receive overtime wages when they work long hours1 The amount of overtime depends on the length of the employees shift and the number of days.

Calculate Overtime In Excel Google Sheets Automate Excel

Overtime Pay Calculators

Overtime Pay Calculators

Overtime Pay Calculators

Hourly Paycheck Calculator Step By Step With Examples

How To Calculate Overtime Pay For Hourly And Salaried Employees Article

How To Quickly Calculate The Overtime And Payment In Excel

Calculate Overtime In Excel Google Sheets Automate Excel

Overtime Pay Calculators

Excel Formula Basic Overtime Calculation Formula

Calculate Overtime In Excel Google Sheets Automate Excel

Overtime Calculator

Tom S Tutorials For Excel Calculating Salary Overtime Tom Urtis

How To Calculate Payroll For Hourly Employees Sling

Overtime Calculator Workest

Excel Busn Math 38 Gross Pay And Overtime 5 Examples Youtube

Excel Formula Timesheet Overtime Calculation Formula Exceljet